Most founders spend years building a product but weeks planning their exit. This imbalance costs millions. Whether you are aiming for a strategic corporate advisory, a merger, or a capital injection, the “business of the business” requires a different skillset than the “business of the product.”

Strategic growth isn’t about guessing; it’s about precision. It involves Buy-Side aggression, Sell-Side preparation, and Financial discipline.

This guide serves as your corporate advisory roadmap. We break down the complex machinery of high-level business strategy—from hiring a Fractional CFO to crafting the perfect pitch deck—to help you navigate the journey from “Startup” to “Exit.”

What is Strategic Corporate Advisory? Strategic Corporate Advisory refers to specialized consulting services that help businesses navigate high-stakes events such as Mergers and Acquisitions (M&A), capital fundraising, and market expansion. It typically involves Fractional CFOs, market intelligence researchers, and deal-flow experts to maximize valuation and minimize risk.

The Deal Room – Mergers & Acquisitions (M&A)

Target Audience: Founders, Private Equity, Corporate Development

The ultimate goal of many startups is a liquidity event. But deals don’t happen in a vacuum; they happen in a structured market.

1. Sell-Side M&A (The Exit Strategy)

Selling your company is likely the biggest financial transaction of your life. You cannot afford to “wing it.” Sell-side advisory isn’t just about finding a buyer; it’s about packaging your financials, IP, and team to maximize the multiple.

- The Strategy: Prepare your “Data Room” 12 months before you intend to sell.

- Deep Dive: Don’t leave money on the table. Read: Sell-Side Acquisition Services: A Strategic Tool for Startups.

2. Buy-Side M&A (Growth via Acquisition)

Organic growth is slow. Smart companies grow by buying their competitors or complementary technologies. Buy-side services help you identify targets, conduct due diligence, and negotiate terms that don’t dilute your own value.

- The Strategy: Acquire “Talent” (Acqui-hire) or “Technology” to leapfrog competitors.

- Deep Dive: Accelerate your timeline: Buy-Side Merger Services: A Strategic Advantage for Startups.

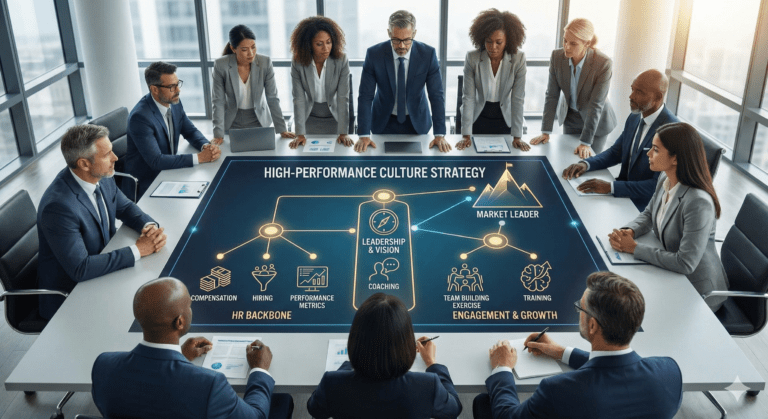

The Financial Brain – Leadership & Capital

Target Audience: CFOs, Investors, Board Members

Strategy without capital is just a hallucination. You need the financial discipline to manage cash flow and the narrative to raise more of it.

3. Financial Leadership (Fractional CFO)

You might not need a full-time CFO, but you definitely need CFO-level thinking. A “Fractional CFO” provides the high-level financial modeling, audit preparation, and board reporting you need at a fraction of the cost of a full-time executive.

- The Strategy: Move beyond “Bookkeeping” to “Financial Strategy.”

- Deep Dive: Get the oversight you need: Why Your Startup Needs an Advisory CFO: The MyB2BNetwork Advantage.

MyB2BNetwork

Discover how to unlock target markets and hit your number with insight-driven engagement.

4. Capital Injection (Pitch Deck)

Your pitch deck is your shop window. Investors see hundreds of decks a week; yours needs to stand out instantly. It’s not about pretty slides; it’s about a compelling narrative of problem, solution, and market size.

- The Strategy: Sell the “Vision,” but back it with “Unit Economics.”

- Deep Dive: Secure your next round: Struggling to Create a Compelling Pitch Deck?.

The War Room – Intelligence & Planning

Target Audience: VP of Strategy, Product Owners

Before you execute, you must validate. This section covers the research and roadmapping required to ensure your ladder is leaning against the right wall.

5. Market Intelligence (Focus Groups)

Assumption is the mother of all failures. Focus groups provide the qualitative data that spreadsheets miss. They tell you why a customer buys, not just what they buy. This validation is critical before a pivot or a new product launch.

- The Strategy: Test your messaging before you spend your ad budget.

- Deep Dive: Hear the voice of the customer: Crafting Effective Focus Group Templates for Mid-Level Marketers.

6. Business Planning (Roadmaps)

A goal without a plan is just a wish. Strategic business planning documents your 1, 3, and 5-year horizons. It aligns your product, marketing, and sales teams under a single “North Star.”

- The Strategy: Your roadmap should be a living document, not a PDF on a shelf.

- Deep Dive: Unblock your growth: Is Your Business Planning Stalling Your Growth?.

7. Strategic Consulting (Problem Solving)

Sometimes, you just need a “Fixer.” General strategic consultants act as SWAT teams for specific, complex problems—whether it’s entering a new market, restructuring a department, or navigating a crisis.

- The Strategy: Rent the expertise you don’t have in-house.

- Deep Dive: Solve the unsolvable: Is Outsourcing Strategic Consulting a Game Changer for Startups?.

Strategic Corporate Advisory

Q: When should I hire a Sell-Side Advisor? A: Ideally, 12 to 24 months before you want to exit. This gives them time to clean up your cap table, optimize your EBITDA, and create a competitive bidding environment.

Q: What is the difference between a Controller and a Fractional CFO? A: A Controller looks backward (ensuring the books are accurate). A CFO looks forward (forecasting cash flow and strategy). You need a CFO to raise money or sell the company.

Q: Why pay for focus groups in the age of Big Data? A: Big Data tells you what happened. Focus groups tell you why. For brand positioning and emotional resonance, human feedback is irreplaceable.

Conclusion: Strategy is the Art of Sacrifice

Great strategy isn’t about doing everything; it’s about deciding what not to do so you can dominate the few things that matter. Whether you are buying, selling, or building, the right advisory partner accelerates your decision loop.

What is your next strategic move? If you are preparing for an exit, start with Sell-Side Services. If you need to fix your financials first, look at Fractional CFO.

Now that you’re here

MyB2BNetwork generates new leads, offers insight on your customers

and can help you increase your marketing ROI.

If you liked this blog post, you’ll probably love MyB2BNetwork, too.