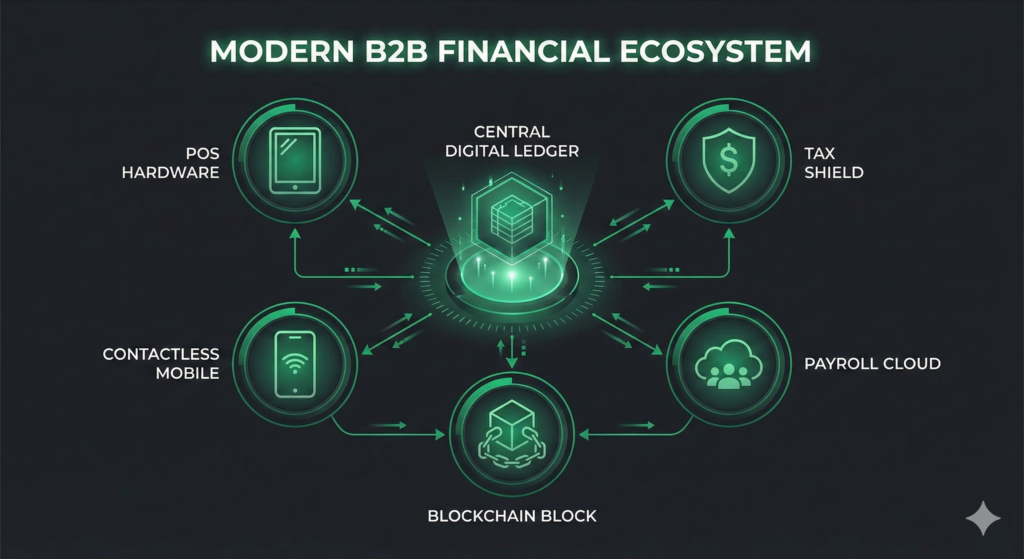

Cash flow is the lifeblood of business, but operations are the heart. If your heart beats irregularly—missed payroll, delayed invoices, or clunky checkout experiences—the whole body shuts down. In 2025, B2B financial operations are no longer just about balancing the books. They are about velocity. How fast can you accept a payment? How accurately can you forecast tax liability? Seamlessly can you pay a remote workforce?

This guide breaks down the modern B2B financial operations stack for startups and SMEs, from the physical hardware at the counter to the invisible blockchain ledger in the cloud.

1. POS System Outsourcing: The Command Center

The Logic: The checkout counter is no longer a transaction point; it is a data hub. Hardware must match strategy.

If you are in retail or hospitality, your Point of Sale (POS) is your operating system. Legacy systems that just “take money” are liabilities. Modern POS systems track inventory in real-time, manage customer loyalty programs, and integrate with your accounting software.

Finding the perfect fit—whether it’s a mobile tablet for floor staff or a robust terminal for high volume—is a critical infrastructure decision. You don’t buy a POS anymore; you subscribe to a customized solution.

Find Your Fit: > Why Startups and SMBs Need POS System Services (And How to Find the Perfect Fit)

2. Merchant Services Essentials

The Logic: Every swipe costs money. Understanding the “middleman” is how you protect your margins.

“Merchant Services” is the umbrella term for the backend relationships that allow you to accept credit cards. It is also where many SMBs bleed profit through hidden fees and tiered pricing models.

Optimizing your merchant services isn’t just about finding the lowest rate; it’s about integration. Does your payment processor talk to your CRM? Does it offer fraud protection? Outsourcing this negotiation to experts can free up your time and significantly lower your effective rate.

Focus on Growth: > Why Merchant Services Are Essential (And How to Free Up Time to Focus on Growth)

3. Contactless Payment Adoption

The Logic: Friction kills sales. In 2025, tapping a phone isn’t a “nice to have”—it’s the standard.

The data is clear: consumers spend more when the payment friction is removed. Contactless payments (NFC, Apple Pay, Digital Wallets) are the fastest-growing transaction method globally.

For B2B businesses, this extends to “One-Click” invoicing. If you are still asking clients to mail checks or manually type in card numbers, you are adding friction to your own cash flow. Embracing contactless tech positions your brand as modern and customer-centric.

Go Seamless: > Why Startups Need to Embrace Contactless Payments

MyB2BNetwork

Discover how to unlock target markets and hit your number with insight-driven engagement.

4. Tax Planning & Filing

The Logic: The only thing more expensive than paying taxes is paying the penalties for getting them wrong.

Tax compliance is the single biggest source of anxiety for founders. As tax codes change (especially regarding digital goods and remote employees), the risk of error increases.

Strategic tax planning isn’t just about filing on time; it’s about liability reduction. Professional planners look forward, not backward, helping you structure your expenses to maximize deductions legally. Don’t let tax season paralyze your operations.

End the Struggle: > Is Your Business Struggling with Tax Planning, Preparation, and Filing?

5. Payroll Management

The Logic: Your team eats first. Messing up payroll breaks trust faster than anything else.

Payroll sits at the uncomfortable intersection of HR (people) and Finance (money). As you scale, specifically with remote or contract workers, the complexity explodes. Different states have different withholding laws.

Outsourcing payroll is often the first “FinOps” move a startup makes. It shifts the burden of calculation, direct deposits, and tax withholdings to a dedicated provider, ensuring your team gets paid correctly, every time.

Tame the Beast: > Taming the Payroll Beast: Why Small Businesses Need to Outsource

6. Accounts Payable/Receivable (AP/AR)

The Logic: Profit is an opinion; Cash is a fact. Managing the timing of money in vs. money out is the art of survival.

Many profitable businesses go bankrupt because they run out of cash. This is the Liquidity Trap.

- Accounts Receivable (AR): Getting paid faster.

- Accounts Payable (AP): Paying bills strategically (not too early, never late).

Outsourcing AP/AR functions ensures that invoices are chased professionally (without you having to be the “bad guy”) and vendors are managed efficiently, keeping your cash flow healthy.

Tame Cash Flow: > Taming the Cash Flow Beast: Why Startups Need Accounts Payable/Receivable Support

7. Blockchain for Business

The Logic: It’s not just crypto hype. It’s about trustless, immutable record-keeping.

Why is a “future tech” topic in a finance guide? Because Blockchain is redefining the ledger. For B2B companies dealing with complex supply chains or international contracts, blockchain offers a way to “Smart Contract” your operations—releasing payments automatically only when goods are verified.

It is the ultimate form of automated trust. Understanding how to integrate this now puts you years ahead of the competition.

Supercharge Your Startup: > Why Blockchain Can Supercharge Your Startup (And How to Get Started)

Conclusion: B2B Financial operations

B2B Financial operations are no longer a series of isolated tasks. Your POS talks to your Merchant Account; your Merchant Account feeds your Cash Flow (AR); your Cash Flow funds your Payroll.

By optimizing each cluster of this ecosystem, you build a financial engine that doesn’t just account for the money—it helps you make more of it.

Now that you’re here

MyB2BNetwork generates new leads, offers insight on your customers

and can help you increase your marketing ROI.

If you liked this blog post, you’ll probably love MyB2BNetwork, too.