Many businesses—especially growing startups and SMEs—find themselves struggling to keep up with the demands of accurate, timely, and secure financial operations. As your company expands, managing account maintenance internally can stretch your resources thin and introduce risks that could hurt your bottom line. That’s why more and more companies are turning to outsourcing as a smart, strategic move. However, outsourcing financial tasks comes with its own set of challenges.

Common Pain Points in Outsourcing Company Accounting Maintenance Services

1. Finding Reliable Service Providers:

One of the biggest hurdles is identifying a trustworthy outsourcing partner. With countless vendors claiming to be experts, it can be difficult to verify their credentials, past performance, and industry knowledge.

2. Quality Control:

Financial accuracy is non-negotiable. When working with remote teams, maintaining consistency and accuracy across bookkeeping, compliance, and reporting functions becomes a serious concern—especially if there are no robust quality assurance processes in place.

3. Communication Gaps:

Efficient collaboration hinges on clear, timely communication. Language barriers, time zone differences, and cultural misunderstandings can all impact project timelines and increase the risk of errors.

4. Data Security Concerns:

Financial data is extremely sensitive. Companies often worry about how well their outsourced providers safeguard confidential information, especially in light of increasing cybersecurity threats and data protection regulations.

5. Contractual Complexities:

Negotiating service level agreements (SLAs), understanding contract clauses, and managing ongoing compliance can drain internal resources—especially for companies without legal expertise.

Why Outsourcing Still Makes Sense: Key Advantages

Despite the challenges, outsourcing your company’s account maintenance services can unlock major benefits:

Cost Savings:

Reduce expenses associated with full-time staff, office space, technology, and training. Outsourcing transforms fixed costs into flexible, scalable solutions.

Increased Operational Efficiency:

Experienced outsourcing partners use advanced tools and standardized processes to deliver faster, more accurate results—freeing up your internal team to focus on what they do best.

Focus on Core Business:

By offloading routine accounting and compliance tasks, your leadership team can dedicate more energy to strategic decision-making, growth, and innovation.

Access to Expertise:

Work with financial professionals who are up-to-date with the latest industry trends, regulatory changes, and best practices—without having to hire in-house experts.

Flexibility & Scalability:

Outsourcing offers the ability to scale financial operations in line with your business needs. Whether you’re expanding to new markets or navigating a temporary surge in workload.

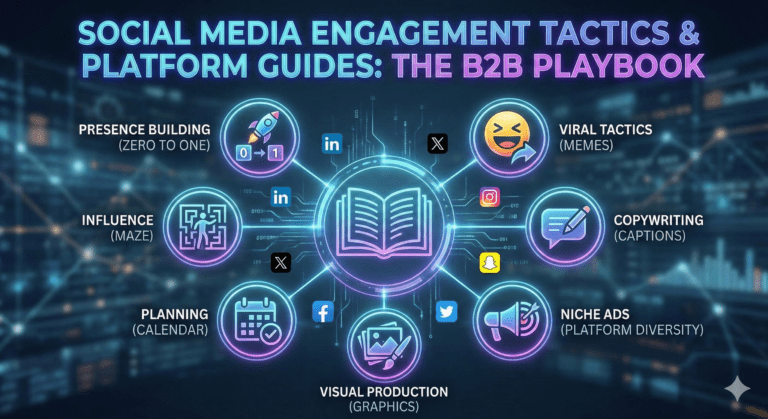

MyB2BNetwork: Your Solution to Efficient Outsourcing

MyB2BNetwork is a leading B2B service marketplace that connects businesses with reliable service providers worldwide. By submitting a single requirement form, you can receive multiple quotations from trusted service providers, allowing you to compare prices, services, and reviews.

Key Benefits of Using MyB2BNetwork:

- Global Reach: Access a vast network of service providers from around the world.

- Simplified Sourcing: Streamline the sourcing process with a user-friendly platform.

- Quality Assurance: Rigorous screening and verification processes ensure quality.

- Transparent Pricing: Get upfront pricing and avoid hidden costs.

- Secure Communication: Protect sensitive information with secure communication channels.

Ready to Simplify Your Financial Operations?

Don’t let accounting headaches hold your business back. Schedule a demo with MyB2BNetwork today and discover how we can help you streamline your financial processes and achieve greater efficiency.